Management conscious of cost of capital and stock price

Management conscious of cost of capital and stock price

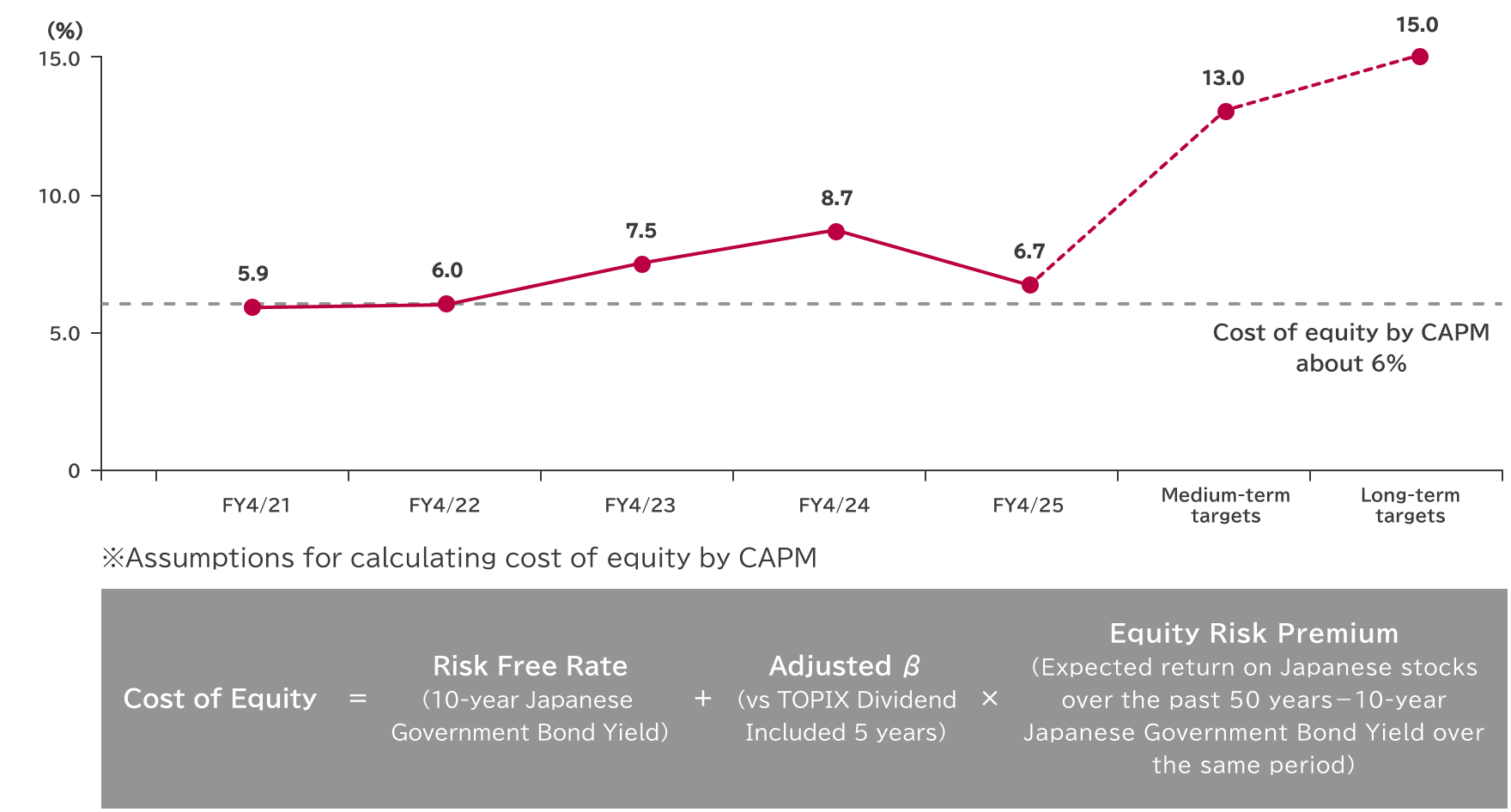

ROE and cost of equity

The Company assumes cost of equity of approximately 6% in the estimates using CAPM. On the other hand, in the course of our proactive stakeholder relations activities, we have learned our cost of capital that investors expect through direct interviews, and we recognize that there is a discrepancy with the CAPM estimate. ROE for the fiscal year ending April 2025 is 6.7%, which exceeds the cost of equity based on the CAPM, but falls short of some of the figures identified at the hearing. Therefore, in order to increase equity spread relative to the cost of capital required by investors, we are expected to reliably achieve the mid-term ROE target of 13% and the long-term target of 15% set forth in our medium- to long-term vision.

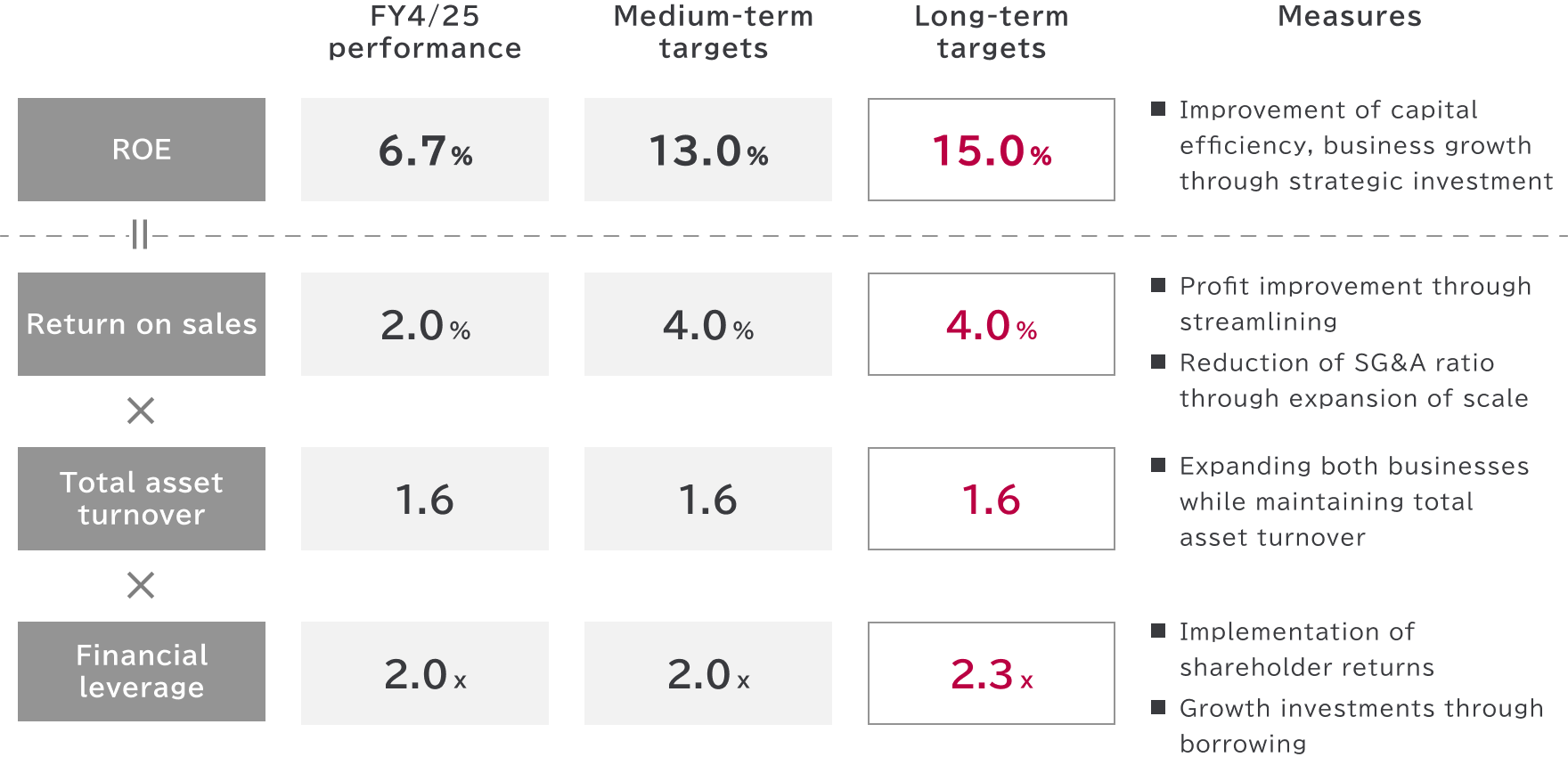

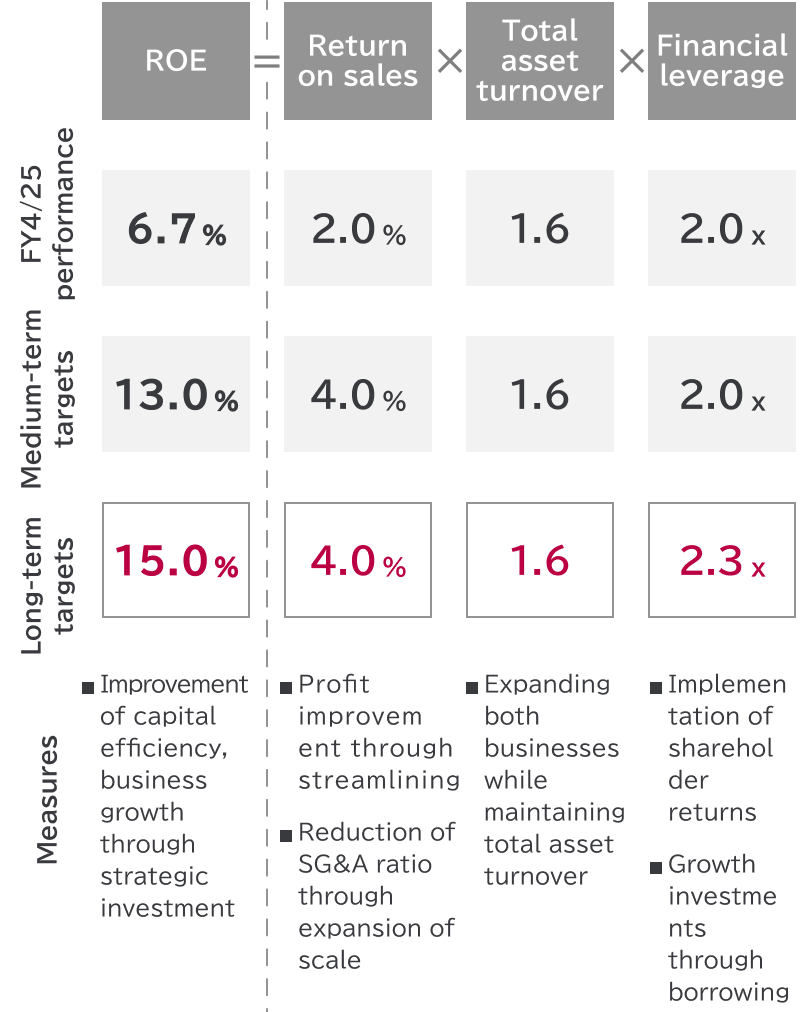

Medium- to long-term ROE targets

In order to further improve return on capital and increase support from the market, the Company has set ROE targets of 13.0% for the medium term and 15.0% for the long term. To achieve these targets, the Company is working to lift the net profit margin (by increasing profitability through efficiency gains and reducing the selling, general & administrative [SG&A] expenses ratio through business expansion) and improve financial leverage (by returning profits to shareholders and using borrowings to invest in growth).

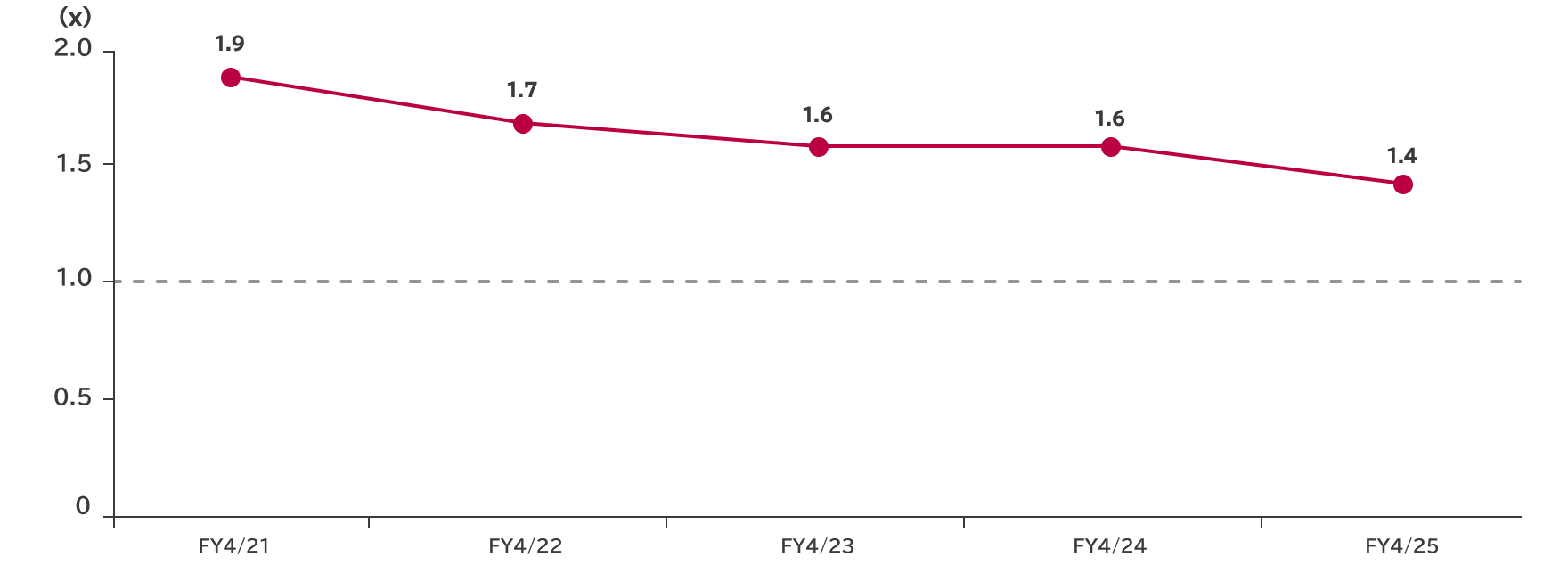

Transition of PBR

As of the end of the fiscal year ended April 2025, the PBR was 1.4x, and has continuously remained above 1x, which we believe is a certain level of market valuation. Going forward, we intend to improve the PBR through business growth, shareholder returns, and other measures to increase ROE.