Corporate Governance

AIN HOLDINGS assumes responsibility for people’s health and the well-being of the wider community through its business activities. We promote a highly efficient and transparent management system and implement ongoing initiatives toward enhancement of corporate governance.

Basic Policy for Corporate Governance

Dispensing pharmacies and cosmetic and drug store chains are the key business areas being developed by AIN HOLDINGS. Both of these businesses are characterized by a responsibility towards people’s health, and as such, we recognize the indispensability of continuing with sound and transparent business activities that prioritize compliance.

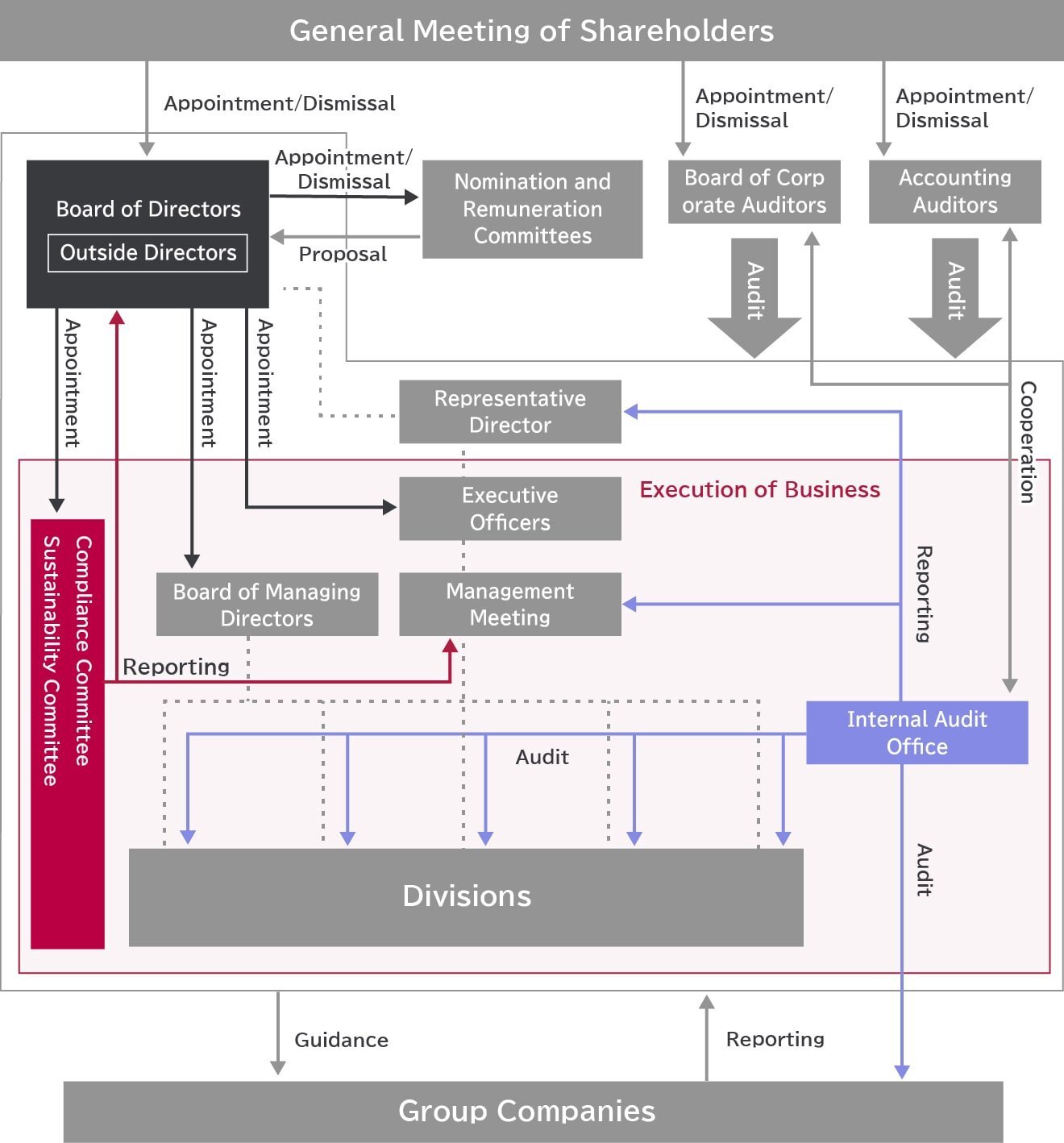

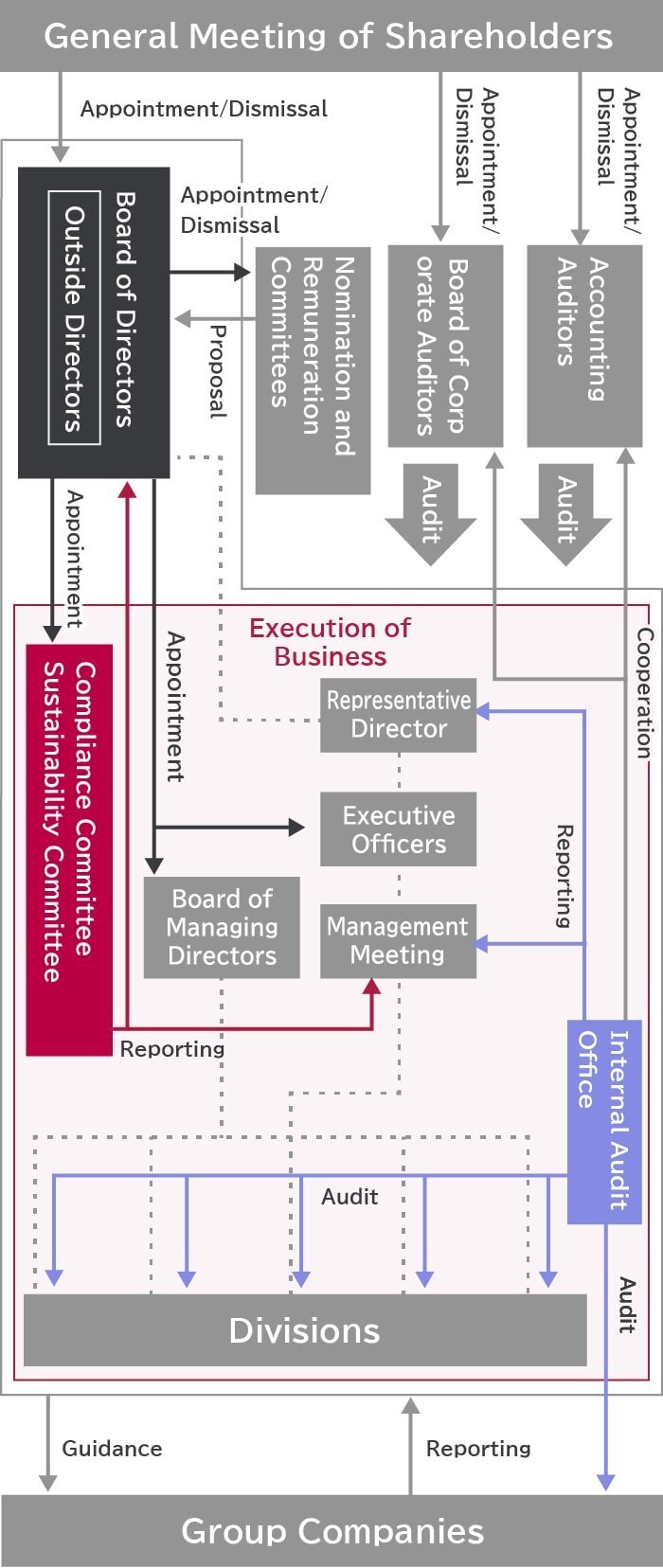

We have adopted a corporate auditor system to oversee not only key management decisions and the business execution of directors, but also general corporate management.

To minimize potential risks, the Internal Audit Office ensures comprehensive compliance with basic pharmacy regulations.

As part of efforts to enhance corporate governance, we have established a Compliance Committee to promote and embed systems that ensure compliance with business ethics, laws and regulations. The committee is made up of all the Company’s directors and auditors and legal advisors. Also, we have established a Sustainability Committee, chaired by the President and Representative Director, to further strengthen our CSR and ESG activities and enhance corporate governance.

Outline of Corporate Governance

| Corporate governance structure | Corporate Auditor System |

|---|---|

| Chairman of the Board | Kiichi Otani |

| Number of directors | 11 (including 4 outside directors) |

| Number of corporate auditors | 3 (including 2 outside corporate auditors) |

| Board of Directors meetings in fiscal 2023 | Number of meetings: 11 Examples of resolutions: Annual budget, issues related to new businesses, store openings |

| Outside director attendance at Board of Directors meetings | 92.5% |

| Outside corporate auditor attendance at Board of Directors meetings | 100.0% |

| Board of Corporate Auditor meetings in fiscal 2023 | Number of meetings: 12 Examples of resolutions: Audit policy, audit plans and business division audits |

| Key meetings attended by corporate auditors | Board of Directors meetings, Board of Corporate Auditor meetings, Management meetings |

| Independent director appointment (as of July 28, 2023) | Outside directors Noriko Endo, Junro Ito, Shigeru Yamazoe and Hideki Kuriyama and outside corporate auditors Akira Ibayashi and Osamu Muramatsu have all been designated as independent officers in accordance with the provisions of the Tokyo Stock Exchange. |

| Systems to strengthen and promote Group management | Group management meetings (regularly) |

| Accounting auditor | Ernst & Young ShinNihon LLC |

Outside Directors and Outside Corporate Auditors

The Board of Directors is comprised of eleven members, including four outside directors. Two of the Company’s three corporate auditors are outside corporate auditors. There are no conflicts of interest between the Company and its outside directors and outside corporate auditors. The outside directors and outside corporate auditors have a number of functions and roles to fulfill in the Group’s corporate governance system. Drawing on their specialist knowledge and experience, they contribute to the Group’s business strategy, discussions on board resolutions, and internal control mainly by monitoring business execution and providing input at meetings of the Board of Directors from a neutral, independent and objective standpoint.

The Company has no specific standards in place at the moment, but the basic policy for appointing outside directors and outside corporate auditors is to ensure they can effectively fulfill the above roles. Four outside directors and two outside corporate auditors have been designated as independent officers in accordance with the provisions of the Tokyo Stock Exchange.

Reasons for Selection of Outside Directors

| Noriko Endo | Ms. Endo was appointed as an outside director to broadly contribute to the Company’s activities by providing advice to the Board of Directors and other bodies and by monitoring business activities, drawing on her extensive knowledge and experience from positions in the editing department of an economics magazine and a public research institution, as well as knowledge gained from market research in Japan and overseas. Ms. Endo previously worked for the Company in an advisory capacity, but the level of mutual dependence between Ms. Endo and the Company is low, as her contract was completed at the end of May 2018. There are no other affiliations that raise questions about Ms. Endo’s independence from the Company’s senior management team. Ms. Endo is judged to have no conflicts of interest with ordinary shareholders and has been designated as an independent officer. |

|---|---|

| Junro Ito |

Mr. Ito was appointed as an outside director to broadly contribute to the Company's activities by providing advice to the Board of Directors and other bodies and by monitoring business execution, drawing on his extensive knowledge of environmental, social and corporate governance (ESG) issues and his experience leading group companies as the director of a major retailer. In addition, one of the Company's subsidiaries has a leasing contract with the major retailer, but the level of mutual dependence is judged to be low as the value of the contract is negligible. There are no other affiliations that raise questions about Mr. Ito's independence from the Company's senior management team. Mr. Ito is judged to have no conflicts of interest with ordinary shareholders and has been designated as an independent officer. |

| Shigeru Yamazoe | Mr. Yamazoe was appointed as an outside director to broadly contribute to the Company’s management activities by providing advice to the Board of Directors and other bodies and by monitoring business execution, drawing on his extensive knowledge and experience as the manager of a major trading company.There is an insurance agreement executed between subsidiary of aforesaid company and the Company, but the Company determines that the agreement has no impact because the amount of transactions is insignificant and the level of interdependence is low. There are no other affiliations that would raise questions about Mr.Yamazoe's independence from the Company’s management. Mr. Yamazoe is judged to have no conflicts of interest with ordinary shareholders and has been designated as an independent officer. |

| Hideki Kuriyama | Mr. Kuriyama was appointed as an outside director to broadly contribute to the Company’s management activities by providing advice to the Board of Directors and other bodies and by monitoring business execution, drawing on his wide range of knowledge and experience regarding governance and human resource development in organizations, of having served as a manager of a professional baseball team and as a professor at universities, among others. There are no affiliations that would raise questions about Mr.Kuriyama's independence from the Company’s management. Mr. Kuriyama is judged to have no conflicts of interest with ordinary shareholders and has been designated as an independent officer. |

Reasons for Selection of Outside Corporate Auditors

| Akira Ibayashi | Mr. Ibayashi was appointed as an outside corporate auditor to contribute to improvements in sound and efficient business management, drawing on his specialist knowledge from working at financial institutions and his experience in business management. |

|---|---|

| Osamu Muramatsu | Mr. Muramatsu was appointed as an outside corporate auditor to contribute to improvements in sound and efficient business management, drawing on his specialist knowledge from working at a major securities firm, experience in business management and track record as an outside auditor for the Group. |

Remuneration for Directors and Auditors

The maximum total amount of remuneration for directors was determined by a resolution at the 53th Ordinary General Meeting of Shareholders held on July 28, 2022 to be ¥500 million annually (does not include payments made to directors for their duties as employees; the maximum total amount for outside directors was determined to be ¥50 million annually).

The maximum total amount of remuneration for corporate auditors was set at ¥30 million annually at the 22nd Ordinary General Meeting of Shareholders held on July 30, 1991.The actual amount each year is determined within this limit via discussions among the corporate auditors.

The amount of remuneration for directors and corporate auditors for the year ended April 2023 is as follows:

| Item | Total remuneration (¥ million) | Number of eligible individuals |

|---|---|---|

| Directors (excluding outside directors) | 214 | 8 |

| Corporate auditors (excluding outside corporate auditors) | 7 | 1 |

| Outside directors and outside corporate auditors | 31 | 7 |

Status of Accounting Audits

Three certified public accountants from Ernst & Young ShinNihon LLC conducted the accounting audits of AIN HOLDINGS based on the Companies Act and Financial Instruments and Exchange Act. Audit fees for the year ended April 2023 are as follows:

| Compensation paid for audit certification activities (¥ million) |

Compensation paid for non-audit activities (¥ million) |

|

|---|---|---|

| The Company | 53 | - |

| Consolidated subsidiaries | 9 | - |

| Total | 62 | - |

Independence Criteria for outside directors and outside corporate auditors

The company determines “Independence Criteria for outside directors and outside corporate auditors” and “Immaterial Criteria for the judgement that the relationship with the Company is unlikely to affect shareholder’s decision concerning the exercise of voting rights” in order to judge their independence objectively.

Independence Criteria for outside directors and outside corporate auditors

An outside director and/or an outside corporate auditor of the Company (hereinafter referred to as the “outside officer”) will be determined as sufficiently independent from the Company if the said outside officer satisfies the requirements set forth below:

1. Presently or at any time within the past ten years, the person has never been an executing person of the Company or a consolidated subsidiary (hereinafter referred to as the “AIN Group.”)

2. Presently or at any time within the past five years, the person has not fallen under any of the following items:

(1) A person who directly or indirectly holds 10% or more of voting rights of the Company, or its executing person;

(2) A person of a company of which the AIN Group holds directly or indirectly 10% or more of the total voting rights, or its executing person;

(3) A counterparty which has transactions principally with the AIN Group (total amount of transactions with the AIN Group exceeding 2% of annual consolidated sales of the party), or its executing person;

(4) A principal counterparty of the AIN Group (total amount of transactions with the party exceeding 2% of annual consolidated sales of the AIN Group), or its executing person;

(5) A consultant, accounting professional or legal professional who has been paid by the AIN Group a large amount of money exceeding the greater of 10 million yen or 2% of the gross income of the person or other assets in addition to the remuneration for directors. (in the event that the consultant, accounting professional or legal professional is an organization such as an artificial person or association, a person who belongs to such organization is included);

(6) A person/organization who receives a donation of a large amount of money exceeding the greater of 10 million yen or 30% of the gross expense of the person/organization from the AIN Group, or an executive person;

(7) A person who is a major lender of the AIN Group (total amount of borrowings from the person exceeding 2% of total consolidated assets of the AIN Group), or its executing person;

(8) A person who belongs to auditing firm, which is an accounting auditor of the Company;

(9) An executing person in other company of which the executing person of the Company is an outside officer of the other company

3. If an executing person of the Company or a person listed Clause 2 of this criteria is correspond to an important person (director except outside director, corporate auditor except outside corporate auditor, executive officer, department manager and higher management grades), a person is not a spouse of, relative within the second degree of relationship with said person.

Formulated November 28, 2023

Immaterial Criteria for the judgement that the relationship with the Company is unlikely to affect shareholder’s decision concerning the exercise of voting rights

In the event that an outside director or an outside corporate auditor of the Company (hereinafter referred to as the “outside officer”) satisfies the requirements set forth below, the Company judges that the attribute information of the outside officer is unlikely to affect shareholder’s decision concerning the exercise of voting rights:

1. A counterparty with the total amount of transactions with the AIN Group not exceeding 1% of the annual consolidated sales of the AIN Group nor the sales of the party in the previous fiscal years, or its executing person.

2. A person that has received a donation not exceeding 10 million yen from the AIN Group in the previous fiscal years, or its executing person.

Formulated November 28, 2023

Succession Plan

After the Nomination and Remuneration Committee discusses the ideal personality required for the next president, the Human Resources Development Committee selects candidates as well as formulates and implements a development plan for them. The Nomination and Remuneration Committee evaluates and supervises the status of development.

Development of candidates

Regarding the ideal personality required for the next president, we focus on improving business value over the medium to long term, and need to have business management skills and experience, deep knowledge of finance, as well as a sincere personality. We have selected several candidates and aim to develop them by having them gain specific experience through company management and business operations as directors and executive officers, including at Group companies.

Evaluation of candidates

In addition to evaluation based on the requirements for the next president, candidates are interviewed by outside directors who serve on the Nomination and Remuneration Committee to gain an understanding of their personalities. Under deliberations by the Human Resources Development Committee, as necessary, requirements and processes are reviewed and candidates are replaced. The final candidates are reported to the Board of Directors after deliberation by the Nomination and Remuneration Committee.